Our Commercial Property and Commercial Property Disputes Teams are available on 01225 462871. You can also contact them by email, or by completing the Contact Form at the foot of this page. |

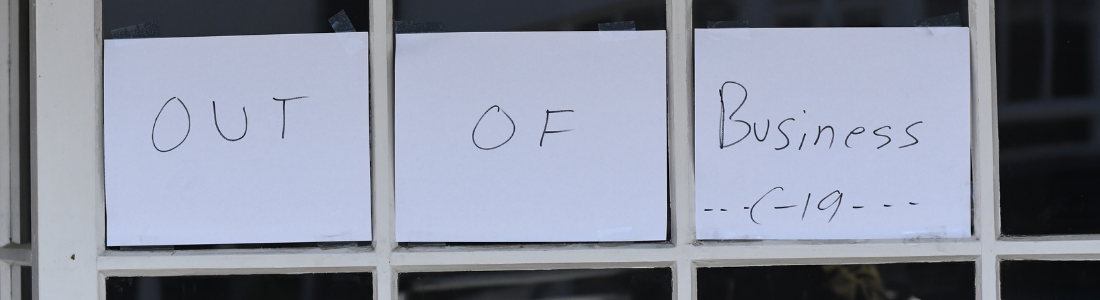

Currently, two-thirds of retailers face legal action from their landlords after 30 June. With the Government’s Code of Practice on commercial rent debt branded ‘ineffective’ by tenants due to its voluntary nature, many have been relying on further Government action to save their businesses.

After considering responses to their call for evidence launched in April, yesterday the Government further extended until 25 March 2022:

- the lease forfeiture moratorium;

- the restriction on the use of Commercial Rent Arrears Recovery (CRAR) – currently, it can only be used where tenants owe at least 457 days’ rent between 25 March and 23 June 2021, and 554 days’ rent between the 24 and 30 June 2021;

- the restriction on serving statutory demands and winding-up petitions where COVID-19 was the cause of the inability to pay the debt.

Addressing the House of Commons, Chief Secretary to the Treasury, Stephen Barclay, said the decision “strikes the right balance between protecting landlords and supporting those businesses that are most in need.”

He also announced that “we will introduce legislation in this parliamentary session to establish a backstop so that where commercial negotiations between tenants and landlords are not successful, they go into binding arbitration”.

In the meantime, he added, “all tenants should start to pay rent again in accordance with the terms of the lease or as otherwise agreed with the landlord.”

COVID-19 rent debt ringfenced

The new legislation will ring-fence outstanding unpaid rent accumulated as a result of a business forced to remain closed due to the pandemic. Landlords will be expected to make allowances for the ring-fenced arrears of rent from those specific periods of closure and, importantly, to share the financial impact with their tenants.

While the new extension applies to all businesses, the new measures to be introduced by way of primary legislation will only cover those impacted by closures.

Rent debt predating the first lockdown, together with any that has accumulated after the date when restrictions on trading in the relevant sector are lifted, will be actionable by landlords as soon as the moratorium is lifted.

Binding arbitration

The Government anticipate that the new legislation will encourage landlords and tenants to work together towards an agreement on how arrears will be dealt with. A binding arbitration process will be put in place if agreement cannot be reached, further focusing the parties’ minds.

Overall, the feeling is that landlords will be better off in the first instance attempting to reach agreement their tenants, as government intervention is only likely to delay rent payments further.

Review of commercial landlord and tenant legislation

The awaited review of commercial landlord and tenant legislation will be launched later in the year to consider a broad range of issues, including the Landlord & Tenant Act 1954 Part II, the impact of COVID-19 on the market, and different models of rent payment.